Heloc loan estimate

Because a HELOC behaves a lot like a credit card in that you can draw from it as needed its tempting to use it for whatever you need. It lets you draw money as you need it.

Heloc Loan Calculator Flash Sales 59 Off Www Ingeniovirtual Com

A HELOC home equity loan will give you the most favorable monthly payment terms due to the length of the loan available.

. The results will compare your new home equity loan payments to the monthly cost of the old debts the effective interest rate and the total monthly payment on those debts. Your HELOC limit can be determined using the loan to value LTV ratio and remaining mortgage balance. If you are applying for a HELOC a manufactured housing loan that is not secured by real estate or a loan through certain types of homebuyer assistance programs you will not receive a GFE or a.

How our HELOC calculator. If you dont have enough equity in your home or your credit score is low you may not qualify for a home equity loan. The payment reduction may come from a lower interest rate a longer loan term or a combination of both.

An FHA construction loan will have a few more stipulations as well such as land ownership involved in the. A home equity line of credit or HELOC could help you achieve your life priorities. It allows home owners to borrow against.

In that case you most likely wouldnt qualify for a home equity loan or HELOC. HELOC Payments How are HELOC repayments structured. If you want to have the flexibility to tap into your home equity multiple times on an ongoing basis for recurring needs then a HELOC.

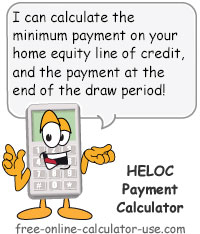

This is the amount you want to borrow. Upwards of 30 -45 days. HELOC Important Terms.

The draw period is the phase. Enter your loans interest rate. A home equity loan make sure you understand the total package of fees that you would have to pay.

Consolidating multiple debts means you will have a single payment monthly but it may not reduce or pay your debt off sooner. Key benefits of this loan compared to one you would secure at a bank include. Lenders typically look at your home equity your loan-to-value ratio your debt-to-income ratio and your credit score before they decide whether you qualify for a home equity line of credit.

With so many ways to tailor your loan to. A higher DTI debt-to-income level may be allowed. To qualify for a HELOC you need to meet the requirements set by the lender.

Unlike a home equity loan which provides a lump sum a HELOC is a revolving line of credit. If however you only owed 200000 on your mortgage you would have 100000 or 33 in equity and most likely. Maximum loan amount for primary residences is 1000000.

15000 to 750000 up to 1 million for properties in California. If youre not sure how much youre eligible for use our home equity loan and HELOC amount calculator first. Variable - AK.

Why BMO Harris Bank is the best home equity loan for different loan options. These numbers can also affect the interest rate they might offer you on a HELOC. While a HELOC offers the most favorable terms typically they take the longest for approval.

Formed by leading contractors Service Nation offers an unmatched selection of HVAC Plumbing Remodeling and Smart Home best practice tools to help you generate leads close more sales market your company recruit technicians and plumbers price for profit manage your service agreements and create an exit strategy. Loan 1 Loan 2 Loan 3. When you get a HELOC through Prosper your mortgage and HELOC combined can be.

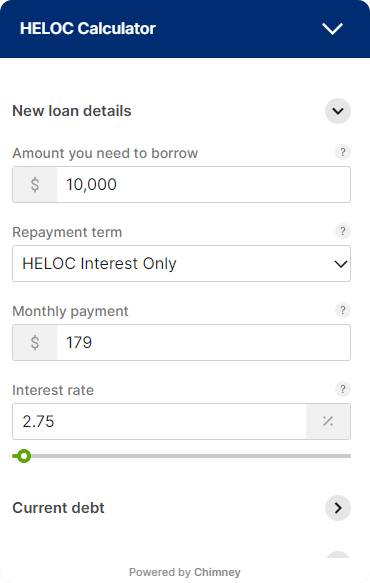

All fields are required. By extending the loan term you may pay more in interest over the life of the loan. If your home is worth 100000 and you owe 40000 on your mortgage then your CLTV is 40.

FICO Score 680 80. For line amounts greater than 100000 maximum combined loan-to-value ratios are lower and certain restrictions apply. If you estimate your homes value at 300000 and you have a mortgage loan for 200000 you have 100000 in equity.

A HELOC is not an ATM. It lets you draw money as you need it. It can play a big role in the interest rate that you get since the appraisal helps determine your LTV loan-to-value ratio.

Before you decide on a HELOC vs. At Bank of America we want to help you understand how you might put a HELOC to work for you. Sign and send the authorization form which confirms you want to close your account.

A Piggyback HELOC is a HELOC that is opened at the same time the home is purchased or refinanced. As noted above a HELOC is an adjustable-rate loan and a fixed-rate loan might be a safer alternative if youre holding that loan longer-term. CLTV is your overall mortgage loan debt expressed as a percentage of your homes fair market value.

For lines up to 100000 we will lend up to 80 of the total equity in your home. A HELOC is a line of credit borrowed against the available equity of your home. Loan amounts range from 25000 to 150000 with terms of five to 20 years.

Loan length in months. For those loans you will receive two forms a Good Faith Estimate GFE and an initial Truth-in-Lending disclosure instead of a Loan Estimate. Maximum loan amount for secondvacation homes is 500000.

The calculator will estimate your loan amount based on this information. The HELOC repayment is structured in two phases. Depending on your financial goals a home equity loan might be a better fit.

A home-equity loan also known as an equity loan a home-equity installment loan or a second mortgage is a type of consumer debt. Home equity loans typically range from 5 to 15 years. You must sign and send us the authorization form for your local county clerks office to release the lien on your property.

If your lender will lend you 80 of your equity youll be able to borrow. How it works. FICO Score 720 80.

For example if the LTV ratio is 75 or lower you could get a lower rate because the loan is seen as less risky to the lender. Lender APR Introductory APR Line Amount Range HELOC Terms Max LTV. Payment calculator applies only to the.

It is also enclosed with the payoff quote. To complete the underwriting for the Piggyback HELOC Rocket Mortgage will leverage the same documents that were used for completing the mortgage loan such as loan application appraisal evaluation credit review etc. Enter your loan amount.

Groceries clothes vacations etc. This is the annual interest rate youll pay on the loan. A home equity line of credit HELOC allows homeowners to borrow funds based on the equity they own in the home.

Your home appraisal can also affect your home loan during a refinance. Include the rate of interest any additional equity you would like to withdraw as a cash payment the closing costs associated with the loan and the length of the loan term. The lien release is sent to the county clerks office within 30.

Enter your loan term. The amount you qualify for is based upon the amount of equity available in your home. How to send the authorization to close your account.

Federally-insured program with specific advisors and resources. Reduced down payments even as low as 35.

Heloc Loan Calculator Flash Sales 59 Off Www Ingeniovirtual Com

Heloc Payment Calculator On Sale 57 Off Www Wtashows Com

Heloc Payment Calculator On Sale 57 Off Www Wtashows Com

Heloc Loan Calculator Flash Sales 59 Off Www Ingeniovirtual Com

Home Equity Line Of Credit Heloc Rocket Mortgage

Heloc Payment Calculator On Sale 57 Off Www Wtashows Com

Home Equity Loan Calculator Mls Mortgage Home Equity Loan Calculator Home Equity Loan Mortgage Amortization Calculator

What Is A Home Equity Line Of Credit Or Heloc Nerdwallet

Mortgage Payoff Calculator With Line Of Credit

Home Equity Line Of Credit Heloc Rocket Mortgage

Heloc Payment Calculator With Interest Only And Pi Calculations

Home Equity Loans Selco

Heloc Loan Calculator Flash Sales 59 Off Www Ingeniovirtual Com

Heloc Calculator

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Home Equity Payment Calculator Online 52 Off Www Ingeniovirtual Com

What Is A Heloc And How Does It Work